When you outsource bookkeeping for your business, you can save a lot of time. This also allows you to maintain productivity in the core areas of your business.

Keeping your books in order is an important part of your success as a business. As such, we recommend outsourcing because not everyone can handle their books themselves.

Now, you can find a ton of options available for where to outsource bookkeeping. Because of so many choices, we’ve compiled our top recommendations here. With one of these, you can more than likely outsource bookkeeping for your business with ease.

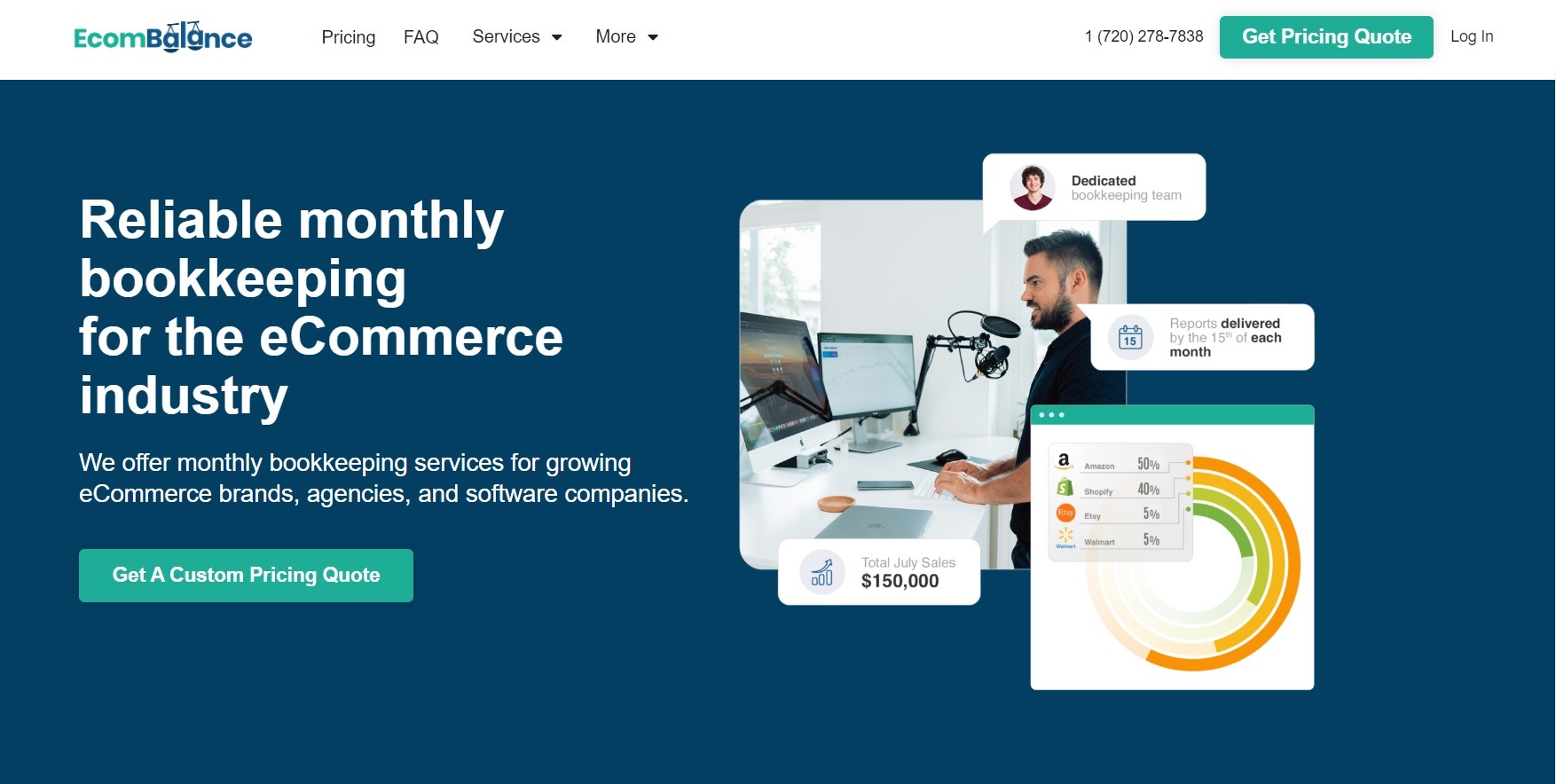

1. EcomBalance

EcomBalance was created to fill a gap left by bookkeeping services aimed at small to medium-sized eCommerce businesses. Having sold millions of dollars’ worth of product on Amazon, the founders are entrepreneurs well-versed in the eCommerce space. They value long-term client relationships and strive to provide pinpoint accurate numbers. This way, they help clients make more informed business decisions.

EcomBalance aims to help businesses selling on all kinds of online platforms such as Shopify, Amazon, eBay, and Etsy with all their bookkeeping needs. They also extend their services to agencies, consultants, coaches, software companies, freelancers, content creators, and others.

What They Offer

- Integration with sales channels and tools: Amazon, Shopify, Ebay, Walmart, Bigcommerce, Xero, Stripe, Square, Intuit Quickbooks

- Onboarding and Assistance connecting all Sales Channels

- A dedicated team of expert eCommerce bookkeepers inclusive of a Head of Bookkeeping and a Bookkeeping Assistant

- Reliable and process-driven bookkeeping vetted by 2 different levels of bookkeepers

- Monthly financial analysis and reports: Profit & Loss statement, Balance Sheet, and Cash Flow statement by the 15th of each month

- Key takeaways for each month and on-demand recommendations and advice for financial decisions

- Fast support: 1 day email response and option to text and call your team

- Tax ready Financials

- Additional services like Clean Up & Catchup Bookkeeping

Note: EcomBalance can do bookkeeping for international companies, but on a case-to-case basis. Contact them to see if your company is a fit.

Plans and Pricing

EcomBalance offers regular, monthly bookkeeping services charged by type of service. You can also choose to pay for a full year upfront for a discount. All Clean Up and Catch Up bookkeeping work is charged upfront.

EcomBalance also offers customized quotes for clients that don’t fit into standard packages. After a call, they will send you a quote for your bookkeeping billed on a monthly basis.

Add-On Services are one-time up front costs that start at $50/month. Let them know during your onboarding call and they will quote you for these additional needs.

For more information, you can visit the Ecombalance pricing page.

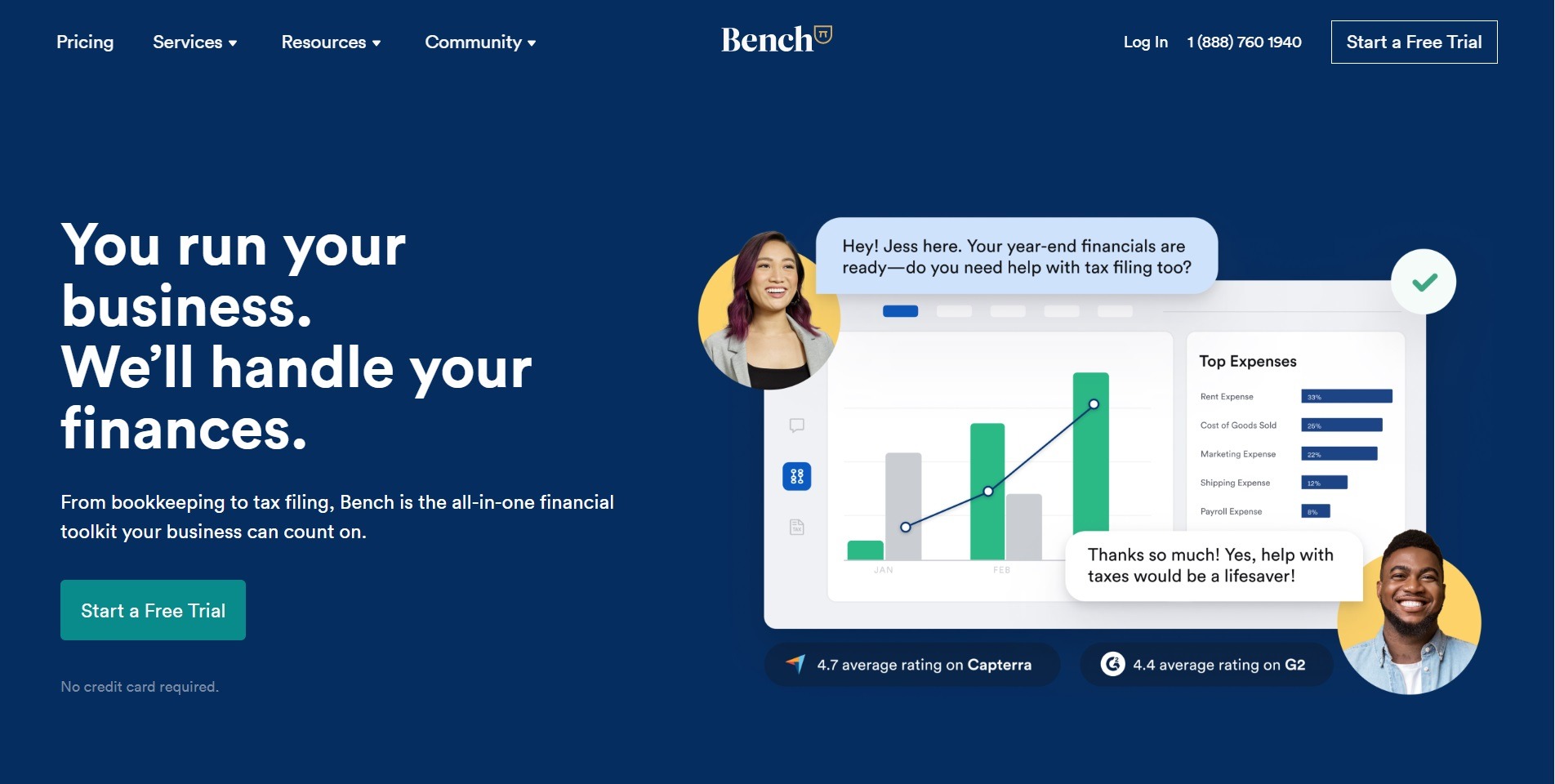

2. Bench

Bench aims to help entrepreneurs focus on what they want to do and their goals for their businesses. They do this by taking care of their bookkeeping and tax needs. They care about making finances something that is simple, effortless, and affordable for small businesses.

Their outsourced bookkeeping solutions combine intuitive online bookkeeping software together with expert, human bookkeepers. They currently support thousands of US-based small businesses in a variety of different industries.

Bench is more than numbers; they care about giving business owners the opportunity to focus on what they care about.

What They Offer

- Secure account connection and automatic uploading of monthly financial statements with Plaid

- Dedicated bookkeeper

- Regular monthly bookkeeping – a modified cash basis method

- Tax Advisory, Tax Preparation and Tax Filing

- Catch Up Bookkeeping – For business <2 years behind bookkeeping

- Bench Retro – Specialized catch up bookkeeping for businesses >2 years behind

- Hybrid software and small business expert financial solutions

- Personalized expert support – get in touch with a dedicated expert any time you have questions or need assistance

- Constant Communication – receive regular updates, 1 business day or less response times, schedule review calls with your bookkeeper (end-of-year or monthly check-ins )

- Tax ready and complete financial statements

- Clear financial reports

- Real-time financial insights

- Tax filing for Premium Plan subscribers complete with year-round tax support and advice

- Year-round 1099 reporting and IRS filing forms

Additional perks:

- Receive discounts if you work with a Bench partner like Stripe or Gusto

- Get a $150 reward and a month of bookkeeping free for every person you successfully refer to Bench

- Bench is tax-deductible

Plans and Pricing

You can choose their Essentials plan and pay either monthly ($299/month) or annually (which comes out to $249/month). You can also go for their Premium plan billed monthly ($499/month) or annually at $399/month.

Their add-on services like historical bookkeeping and other specialized services are separate from their monthly bookkeeping fees.

For more information, you can visit the Bench pricing page.

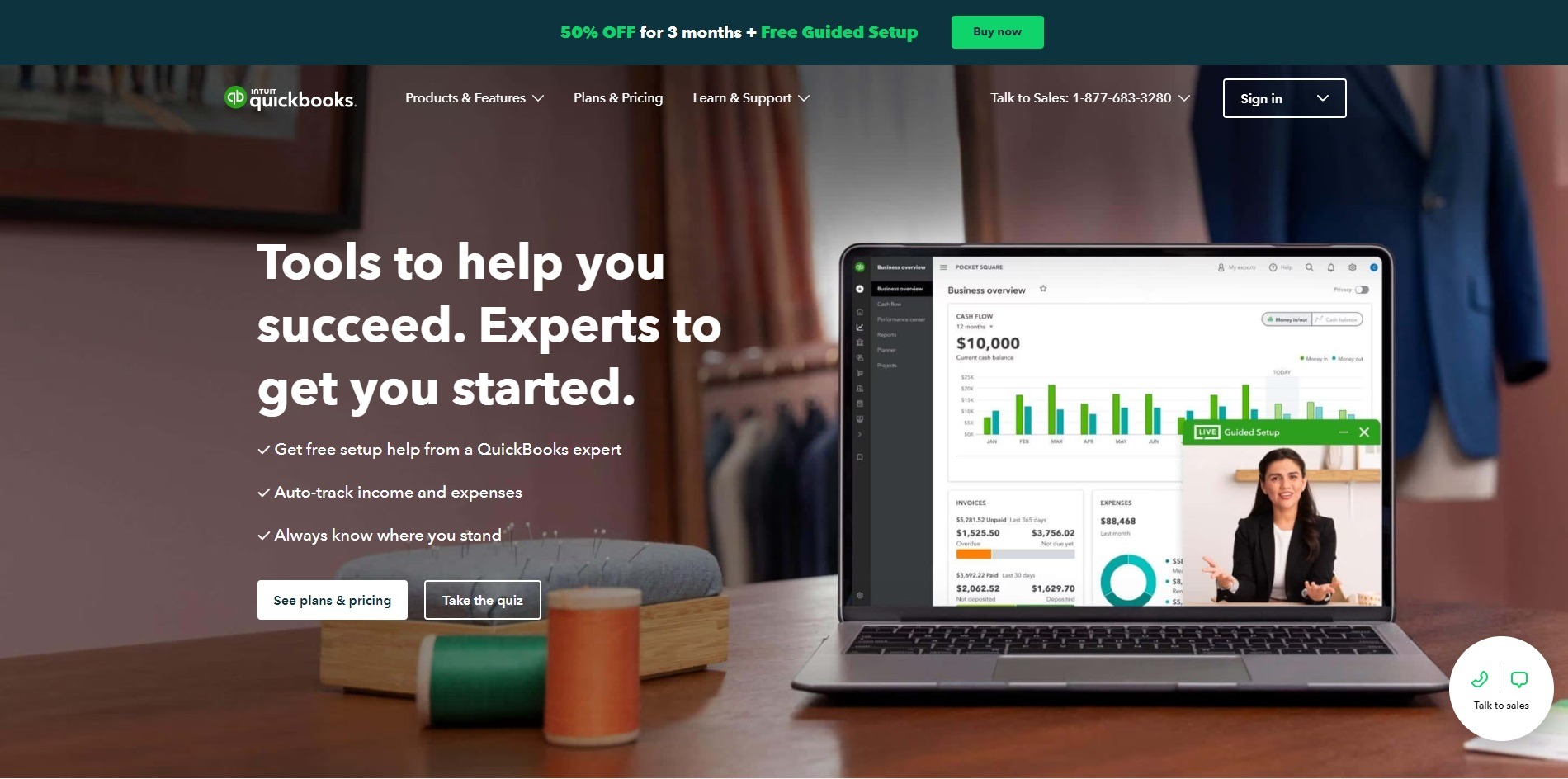

3. QuickBooks

QuickBooks by Intuit is one of the top financial management software solutions you can find. Its solutions are built to help anyone from freelancers to small and medium-sized businesses. Their services include instant invoicing, personalized reports, access to organized records of receipts, payroll, tracking expenses, and tax preparation.

QuickBooks Online can be downloaded on your desktop. You can also use it on your phone via their mobile app (IOS and Android). Alternatively, you can also use the tool as a cloud-based solution wherever there’s internet access.

What They Offer

- Add-on services and features: point of sale solutions, mobile payments, online banking integration, and more

- An easy to use and intuitive software

- 650+ integrations with software and tools you already use

- Cleanup bookkeeping – This is where they thoroughly check your books and bring everything up to date. They also help you with onboarding, setting up your accounts, and connecting your bank.

- Ongoing bookkeeping – a live bookkeeper to handle your books with complete accuracy every month

- Automated accounting procedures – This includes syncing bank info and credit card transactions, issuing invoices, reconciling spending, setting payment reminders, tracking income and expenses, etc.

- Monthly financial statements – Profit and Loss, Balance Sheet, etc.

- Personalized financial reports – Get insights to help you make the next business move. Access 20 different pre-built reports like your trial balance or 1099. These reports are also emailed to you and some are downloadable so you can view them on the go.

- Tax ready financials – Face tax season without the stress

- Access to tax deduction tools

Plans and Pricing

Only cleanup and ongoing bookkeeping services are available for their Full-Service Bookkeeping plan.

Other things not included:

- Sending invoices

- Paying bills

- Management of inventory, accounts receivable, or accounts payable

- Financial advisory services

- Tax advice

- Facilitating the filing of income or sales tax returns

- Creating or sending 1099s

- Payroll management

You can view the details of their pricing tiers on the QuickBooks pricing page.

4. Pilot

Another good choice to outsource bookkeeping to is Pilot. Pilot supports the front office dealings of their customers with their financial management solutions. They were made for startups, growing, and small businesses. These solutions include bookkeeping, tax preparation and filing, as well as CFO services.

Their team of financial experts focus on taking care of your books. This leaves you free to concentrate on other business areas. They aim to provide their clients with unmatched quality and accurate, detailed bookkeeping.

What They Offer

- Monthly bookkeeping performed by professionals and aided by powerful bookkeeping software

- Accrual basis bookkeeping

- Hundreds of integrations with tools and software such as Bill.com, Stripe, QuickBooks, Expensify, and Gusto.

- Dedicated financial expert – Provides in-depth onboarding, helps manage books, taxes, and other additional services like assisting in the selection of payroll and providing financial advice

- Automatic transaction import

- Connect your banks, credit cards, and payment processors

- Chart of accounts

- Complete monthly financial reports (P&L, Cash Flow, and Balance Sheet)

- Monthly industry-specific metrics to inform business decisions

- Full service tax preparation, tax filing, and CFO Services (Tax and CFO are additional expenses)

- For startups – burn rate calculations and reporting

- For eCommerce businesses – inventory updates

Plans and Pricing

Pilot has two pricing tiers: Core and Plus

Core starts at $499/mo billed annually for companies earning $0-$29,000 monthly. The price increases depending on monthly expenses. Plus is a custom pricing tier molded to each client.

Pilot also charges an onboarding /setup fee equal to a month’s worth of bookkeeping. If you are a pre-revenue company, Pilot has a special $200/month discount for the first year.

If you want to go more in-depth, check out the Pilot pricing page.

5. Xendoo

Xendoo offers a hassle-free solution to outsource bookkeeping and accounting needs. Their technology solutions, paired with their dedicated team of financial experts, ensure organized and accurate books delivered on time.

Xendoo’s solutions cater to small and medium-sized businesses. Their team will get to know the ins and outs of your business and industry to help you save money and give you the space you need to grow your business. They love bookkeeping, and they do it so you can do what you love doing.

What They Offer

- Seamless integration with QuickBooks Online and Xero

- Set up your dashboard in under 60 minutes with an Onboarding Specialist to help you connect your accounts for view-only access.

- Weekly reconciling of books

- Dedicated bookkeeper backed by a full team – for accurate, up to date, and compliant bookkeeping

- Clear and regular communication – They will contact you whenever they need clarification regarding your transactions.

- Support – email, text, or call your team whenever you have questions. (8am – 6pm EST and after hours with advanced notice)

- Monthly financials – access them anytime, anywhere

- Tax preparation, tax filing, and tax consulting services -Tax ready financials for tax season

Plans and Pricing

Xendoo offers three pricing tiers based on the monthly expenses of a business. The Essential tier $395. The Growth tier is $695. The Scale tier is $995. The tiers are billed on either a monthly or annual basis.

For more information visit the Xendoo pricing page.

Conclusion

When you outsource bookkeeping, make sure you know what you need, and then do some research to find the service that fits your needs.